Why Accelerate Services by Outsourcing Corporate Credit Line Applications in 2026

In the high-stakes arena of commercial finance, speed is no longer just a luxury; it is the ultimate currency. For mid-market banks and private credit funds, the ability to rapidly facilitate an outsourcing corporate credit line application process can be the difference between a lifelong client and a lost opportunity.

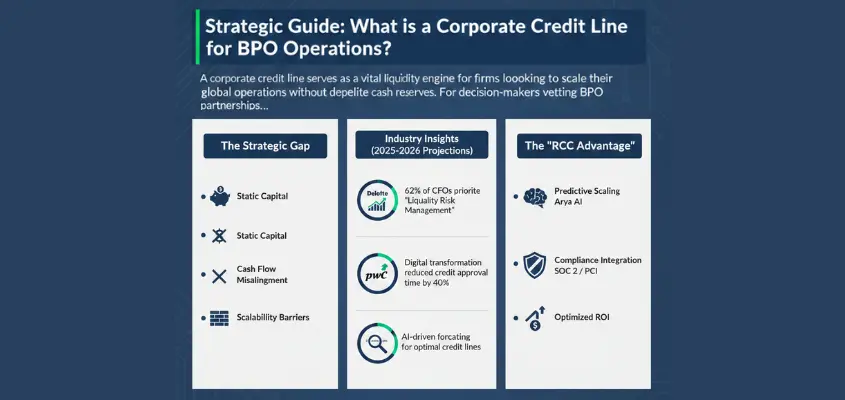

As we navigate the complexities of 2026, the traditional, manual-heavy models of working capital loan servicing are showing their age, often buckling under the weight of fragmented data and shifting regulatory demands. Decision-makers are increasingly realizing that maintaining an in-house, paper-trapping infrastructure is a bottleneck to growth.

By strategically leveraging a commercial lending BPO, institutions can finally bridge the gap between rigorous risk mitigation and the “instant-access” expectations of the modern corporate borrower.

Why Manual Working Capital Servicing Fails in a Volatile Economy?

The 2026 economic landscape is defined by “micro-volatility”—a state in which supply chain shifts or interest rate pivots occur in days, not quarters. In this environment, a corporate borrower waiting three weeks for a credit line increase is a borrower whose business is at risk. For many COOs, the internal reality is a maze of legacy systems and “spreadsheet-hero” underwriting that simply cannot scale.

Manual working capital loan servicing is prone to several executive-level headaches:

- Application Abandonment: Complex, non-digital workflows lead to a 57% abandonment rate among SMEs and mid-market firms.

- Operational Drag: In-house teams spend 70% of their time on document verification rather than strategic portfolio analysis.

- Information Asymmetry: Siloed data makes it nearly impossible to get a real-time view of a borrower’s total exposure.

Precision Underwriting: Balancing Speed with Rigorous Risk Assessment

The greatest fear in commercial lending BPO is that speed comes at the cost of safety. However, the 2026 paradigm shift proves that AI-enhanced underwriting is actually more accurate than human-only review. According to Deloitte’s 2026 Banking Outlook, banks that integrate automated risk scoring see a 25% reduction in non-performing loans (NPLs).

When you choose outsourcing corporate credit line application processing, you are not just buying labor; you are buying an advanced risk engine. Modern BPO partners utilize Intelligent Document Processing (IDP) to “spread” financial statements in seconds. They can flag anomalies that the human eye might miss at 4:00 PM on a Friday. This allows your senior underwriters to focus exclusively on the “gray areas,” while the “green-lit” applications move toward funding at record speeds.

Integrating Agentic AI by Outsourcing Corporate Credit Line Application

At RCC BPO, we don’t just follow the trend; we set the standard with our proprietary technology stack. We understand that corporate credit line support requires a delicate touch—one that balances the cold efficiency of data with the warmth of high-stakes relationship management.

Our secret weapon is Arya, our advanced AI Agent Copilot. Unlike generic bots, Arya is purpose-built for the BFSI sector. When a client initiates a working capital loan servicing request, Arya works behind the scenes to:

- Automate Document Verification: Scouring bank statements and tax filings for instant KYC/AML alignment.

- Real-Time Sentiment Analysis: Guiding our agents to handle sensitive credit conversations with the appropriate tone and urgency.

- Accelerate Drawdown Requests: Reducing transaction processing times by over 45% through automated reconciliation.

Furthermore, our AI QMS (Quality Management System) ensures that 100% of interactions and decisions are monitored for compliance. In a world where “near enough” is never enough, RCC BPO provides a verifiable audit trail for every single credit decision.

Technical Integration: Ensuring SOC 2 Compliance in High-Volume Loan Processing

For C-suite executives, the “O” in BPO often stands for “Overlooked Security.” We eliminate that risk. Our technical infrastructure is designed to act as a seamless, secure extension of your core banking system. Whether we are managing corporate credit line support or complex working capital loan servicing, our “Compliance-First” model is non-negotiable.

Our integration capabilities include:

- SOC 2 Type II & PCI DSS Certification: Ensuring that sensitive corporate financial data is handled with bank-grade encryption.

- API-First Architecture: Our systems plug directly into your Loan Origination System (LOS), eliminating the need for manual data “swivel-chairing.”

- Accent Harmonizer Technology: Our proprietary tool ensures that our global agents from Belize to Morocco communicate with the clarity and professionalism your high-net-worth corporate clients expect.

Plan your Growth Strategies with the RCC BPO Advantage

The decision to move toward outsourcing the processing of corporate credit line applications is a strategic pivot from “running the bank” to “growing the bank.” In 2026, the lenders who win will be those who can say “yes” faster, without saying “yes” to the wrong risks.

RCC BPO offers more than just seats; we offer a tech-enabled ecosystem that reduces “Time-to-Cash” by 40%. Moreover, all this while lowering operational costs by up to 50%. We invite you to move beyond the friction of legacy servicing and embrace the speed of capital.

Ready to transform your commercial lending operations? Schedule a deep-dive consultation on how our “Human + AI” combination can scale your corporate portfolio. Let’s build the future of fluid capital together.