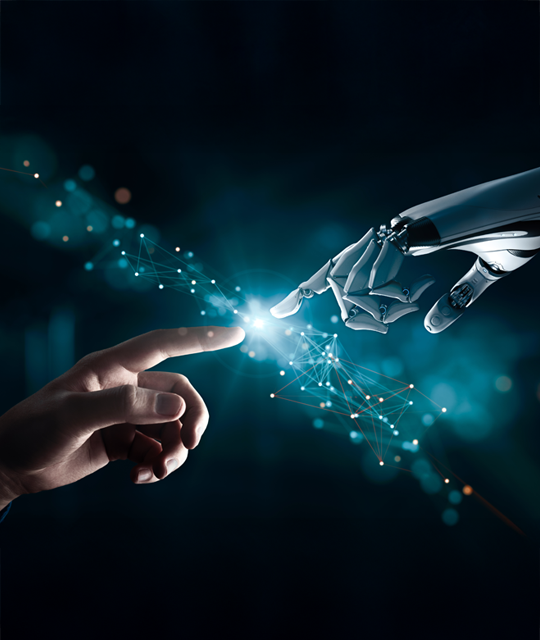

Digital borrowers expect instant approvals, intuitive applications, real-time updates, and mobile-first support. Any friction — unclear instructions, delayed verification, or slow responses — increases application drop-offs and customer acquisition costs.

At the same time, digital lenders must balance speed with strict compliance across KYC/AML, data privacy, fraud prevention, and fair lending standards. Rapid growth cannot come at the expense of regulatory discipline, yet overly complex processes can slow approvals and reduce conversion rates.

Customer experience is now a direct growth driver. Faster onboarding improves funded-loan conversions, proactive servicing reduces support costs, and structured early-stage collections strengthen repayment performance. Platforms that deliver fast, transparent, and compliant borrower journeys gain higher retention, stronger portfolio performance, and greater long-term profitability.