How to Handle the 30-Day Freeze Maintaining 100% Debt Dispute Rights in USA

In the US, when a consumer receives their first notice, they enter a 30-day “Dispute Window.” If they exercise their debt dispute rights in writing during this period, Section 809(b) mandates an immediate cessation of all collection activity. This “pause” must remain in effect until the collector mails verification to the consumer. Many BPOs use a manual “flag” in a CRM to stop calls. Automated dialers often mistakenly ignore these manual flags. This oversight causes illegal calls to continue after a dispute occurs.

Stop Automating Broken Processes – Maintaining Debt Dispute Rights in Collection Support

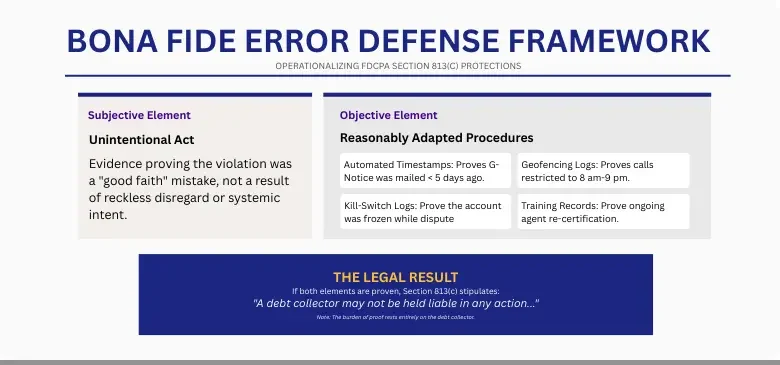

Deloitte’s Tech Trends 2026 warns that 40% of automation projects fail because they automate “broken processes”. Simply “tagging” a dispute isn’t enough. In a 2026 audit, regulators look for “Kill-Switch” evidence. They want to see that the system physically prevents a call or SMS from being sent while the dispute is active. Failure to do so signals a lack of “reasonable procedures,” making the Bona Fide Error defense nearly impossible to claim in USA.

The Global Dispute Lockdown

A resilient dispute workflow includes:

- The Global Kill-Switch: The system locks the account across all channels once it logs a dispute. This happens whether the dispute arrives via mail, a virtual agent, or a web portal. An instant lock prevents any further outreach on the account. This unified response ensures the team remains compliant across every communication platform.

- Validation Gatekeeping: The account stays “on ice” until a compliance auditor uploads the verified documentation and the system logs a “Mail Sent” timestamp. Only then can recovery resume.

- Intelligent Reconciliation: The system separates the “base debt” for continued recovery if a consumer disputes only the interest. It must inform the consumer clearly about this split. This process allows the team to pursue the undisputed amount lawfully. Meanwhile, the system pauses collection on the disputed interest until the team provides validation.

Utilize the ROI of “Trust-Based” Recovery in Debt Collections Processes

Accenture reports that 79% of companies now identify “Trust” as the primary driver of their CX investment. Respecting a consumer’s debt dispute rights isn’t just a hurdle; it’s a moment of truth. By handling disputes quickly and transparently, you demonstrate a level of professionalism that 80% of executives agree will increase collaboration between humans and digital systems by 2026.

Does your BPO have a real “Kill-Switch” for disputes? RCC BPO’s automated Lock-Down protocol stops all outreach once a debtor files a dispute. The system pauses communication until the team mails the required validation. This protocol prevents accidental contact during the legal verification period. Secure your compliance with RCC BPO’s dedicated BFSI outsourcing services for USA.